Rumored Buzz on Kam Financial & Realty, Inc.

Rumored Buzz on Kam Financial & Realty, Inc.

Blog Article

4 Simple Techniques For Kam Financial & Realty, Inc.

Table of ContentsKam Financial & Realty, Inc. Can Be Fun For AnyoneNot known Details About Kam Financial & Realty, Inc. The Best Guide To Kam Financial & Realty, Inc.Not known Factual Statements About Kam Financial & Realty, Inc. Some Known Incorrect Statements About Kam Financial & Realty, Inc. Indicators on Kam Financial & Realty, Inc. You Should KnowThe Greatest Guide To Kam Financial & Realty, Inc.

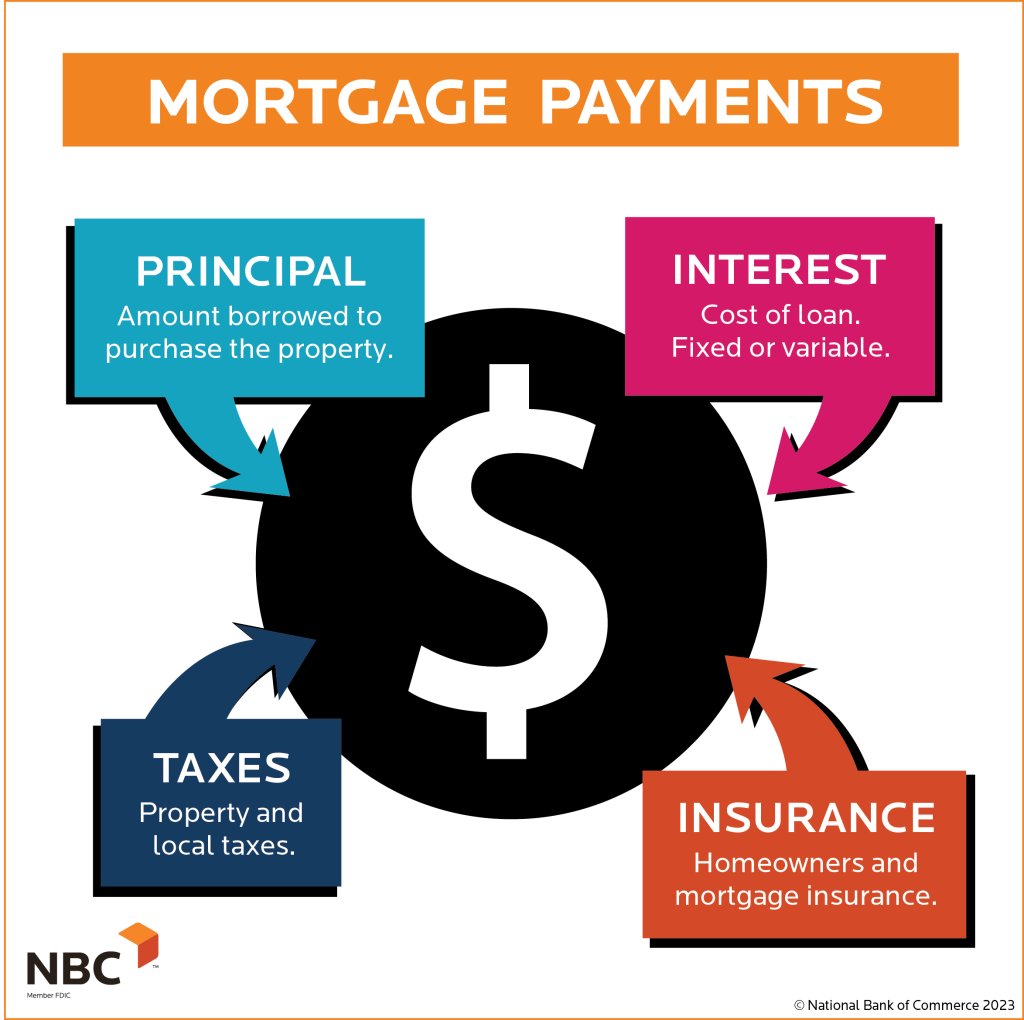

Buying a home is a significant landmark in many individuals's lives. Nevertheless, that doesn't indicate the process is clear to those people. The home acquiring process involves several steps and variables, implying each person's experience will be unique to their family, financial circumstance, and wanted home. However that does not imply we can not assist understand the mortgage process.A is a type of finance you make use of to purchase residential or commercial property, such as a home. Commonly, a lender will certainly give you a collection quantity of cash based on the value of the home you want to buy or have.

The Ultimate Guide To Kam Financial & Realty, Inc.

To receive a mortgage, you will certainly need to be at least 18 years of ages. Aspects that aid in the mortgage procedure are a reliable earnings resource, a solid credit rating, and a modest debt-to-income proportion. https://www.figma.com/design/JpsMymHk0v1UCzFKooR3yz/Untitled?node-id=0-1&t=DgFqK1CfgVW4dei5-1. You'll find out more regarding these consider Module 2: A is when the house owner obtains a brand-new mortgage to replace the one they presently have in area

A features likewise to a first home mortgage. You can obtain a fixed quantity of cash based on your home's equity, and pay it off via repaired monthly repayments over a set term. A runs a little bit in a different way from a traditional home loan and resembles a bank card. With a HELOC, you obtain authorization for a dealt with amount of cash and have the adaptability to obtain what you require as you require it.

This co-signer will certainly consent to make settlements on the home mortgage if the customer does not pay as agreed. Title companies play a critical function guaranteeing the smooth transfer of residential or commercial property ownership. They investigate state and region records to validate the "title", or possession of your house being acquired, is cost-free and free from any type of various other home loans or responsibilities.

Kam Financial & Realty, Inc. Fundamentals Explained

In addition, they provide written guarantee to the loan provider and create all the documentation needed for the home loan. A deposit is the quantity of money you have to pay ahead of time towards the purchase of your home. If you are purchasing a home for $100,000 the loan provider might ask you for a down payment of 5%, which suggests you would be required to have $5,000 in cash as the down settlement to get the home. https://blogfreely.net/kamfnnclr1ty/your-trusted-mortgage-loan-officer-california-kam-financial-and-realty-inc.

The majority of lenders have conventional home mortgage standards that permit you to obtain a specific percentage of the value of the home. The percent of principal you can obtain will vary based on the mortgage program you qualify for.

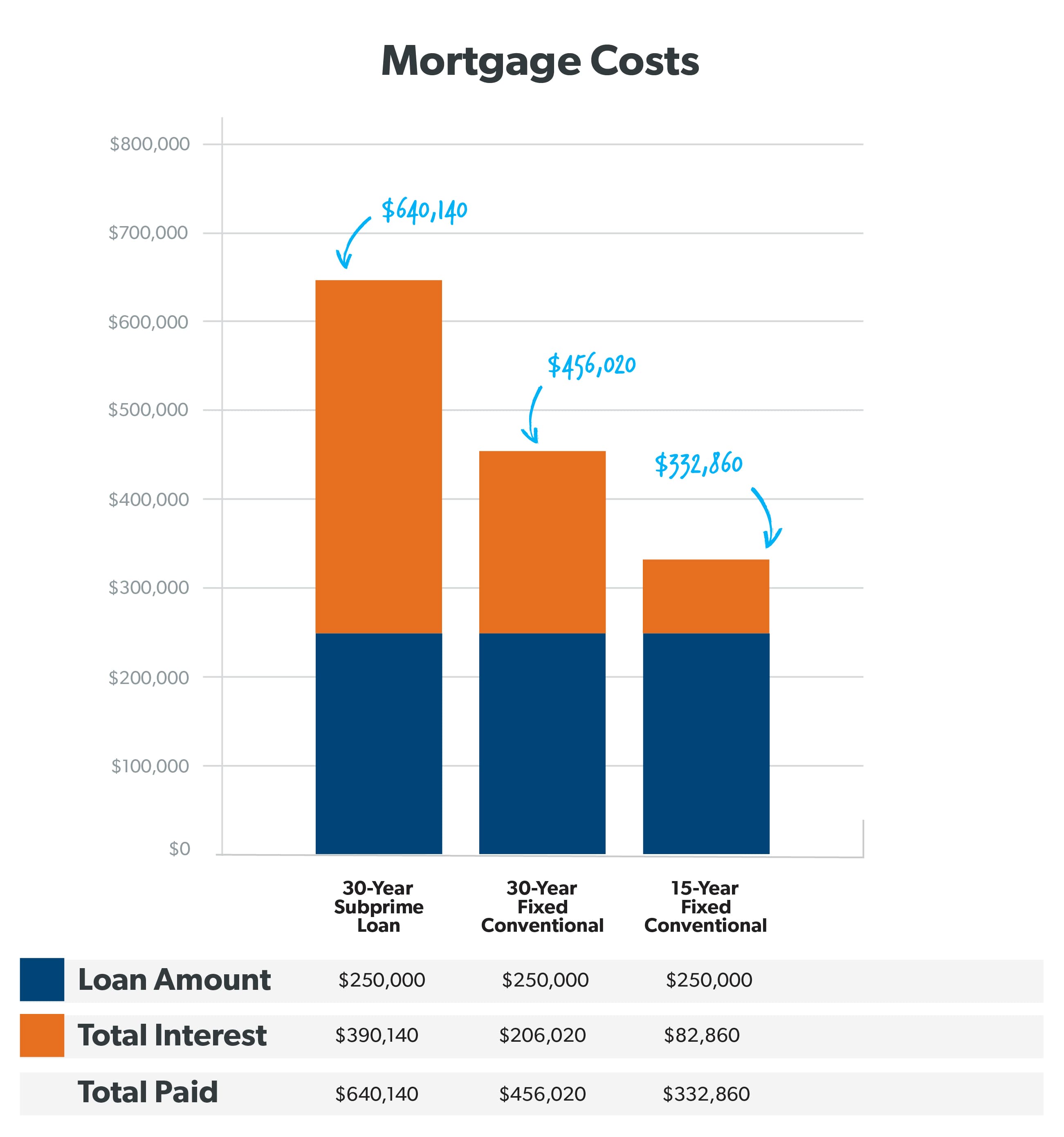

There are special programs for new home buyers, veterans, and low-income debtors that permit lower deposits and greater percents of principal. A home mortgage banker can assess these alternatives with you to see if you qualify at the time of application. Interest is what the lender fees you to obtain the cash to acquire the home.

5 Simple Techniques For Kam Financial & Realty, Inc.

If you were to get a 30-year (360 months) home mortgage financing and borrow that same $95,000 from the above instance, the total amount of passion you would certainly pay, if you made all 360 month-to-month repayments, would certainly be a little over $32,000. Your month-to-month settlement for this finance would certainly be $632.

When you have a home or residential or commercial property you will certainly have to pay real estate tax to the area where the home is located. A lot of loan providers will certainly require you to pay your tax obligations with your home loan settlement. Building tax obligations on a $100,000 funding could be around $1,000 a year. The lending institution will split the $1,000 by 12 months and include it to your settlement.

Kam Financial & Realty, Inc. Things To Know Before You Buy

Once again, because the home is seen as security by the loan provider, they want to make certain it's protected. Like tax obligations, the loan provider will likewise offeror in some cases requireyou to include your insurance policy premium in your month-to-month settlement.

Your payment now would certainly raise by $100 to a new overall of $815.33$600 in principle, $32 in rate of interest, $83.33 in taxes, and $100 in insurance coverage. The lender holds this cash in the same escrow account as your property taxes and makes payments to the insurer on your part. Closing expenses describe the expenses connected with refining your finance.

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Discussing

This ensures you comprehend the overall price and accept proceed prior to the loan is funded. There are various programs and lending institutions you can select from when you're getting a home and obtaining a mortgage that can help you anchor browse what programs or alternatives will certainly work best for you.

Some Known Facts About Kam Financial & Realty, Inc..

Numerous monetary establishments and realty representatives can aid you comprehend just how much cash you can invest in a home and what financing amount you will certainly qualify for. Do some research, however additionally request for recommendations from your loved ones. Discovering the appropriate partners that are an excellent fit for you can make all the difference.

Report this page